How Can Claiming a Dependent Lower Your Taxes?

- By Elizabeth Hammond

- •

- 11 Apr, 2023

- •

Filing taxes requires knowing many personal details that occurred over the past year, such as who lived with you, whom you supported, what your income was, and more. Although these details apply to you, understanding details like who you classify as a dependent can get confusing if you don’t fully understand how that qualification is accurately assigned.

Furthermore, how can claiming a dependent lower your taxes? Knowing who qualifies can yield surprising benefits by the end of the year. Get a closer look at how it all works with our comprehensive guide below.

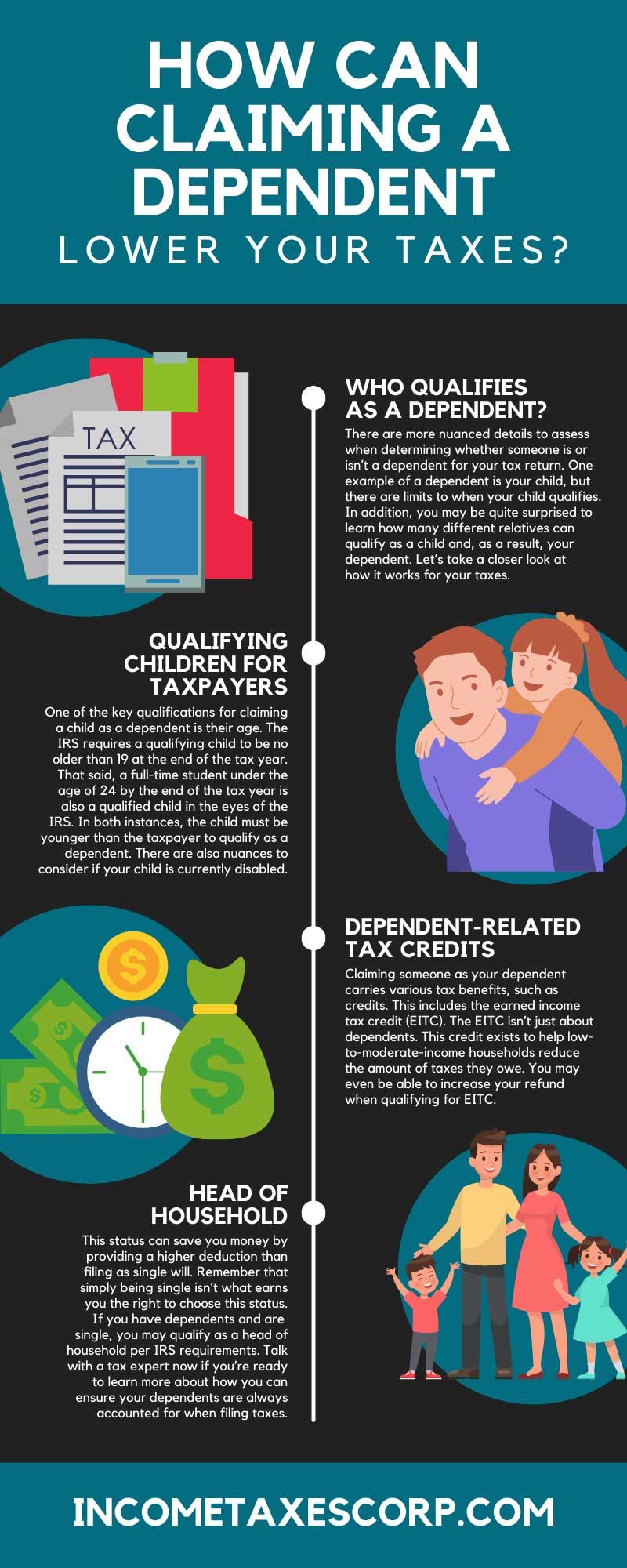

Who Qualifies as a Dependent?

Looking at how dependents lower taxes requires assessing who qualifies for this status in the first place. You will account for dependents when filing your tax return every year. When the taxpayer pays for a majority of someone’s financial support throughout the tax year, the taxpayer can claim them as a dependent.

However, there are more nuanced details to assess when determining whether someone is or isn’t a dependent for your tax return. One example of a dependent is your child, but there are limits to when your child qualifies. In addition, you may be quite surprised to learn how many different relatives can qualify as a child and, as a result, your dependent. Let’s take a closer look at how it works for your taxes.

Qualifying Children for Taxpayers

One of the key qualifications for claiming a child as a dependent is their age. The IRS requires a qualifying child to be no older than 19 at the end of the tax year. That said, a full-time student under the age of 24 by the end of the tax year is also a qualified child in the eyes of the IRS. In both instances, the child must be younger than the taxpayer to qualify as a dependent. There are also nuances to consider if your child is currently disabled.

A child of any age who is permanently and totally disabled will qualify as a dependent. Residency is also key because your child must live in your home for more than half the year to be legally considered a dependent. These requirements also apply to adopted children.

Additional family members who can be a qualifying child include brothers, sisters, step-siblings, and more. Descendants of your siblings, such as nephews or nieces, can qualify as a dependent on your taxes if they meet the qualifications above. That said, it’s important to remember that a child can only be legally claimed as a dependent by one person. If your brother and his daughter live under your roof throughout the year, you can’t both claim the daughter as a dependent when filing taxes.

Parents, Spouses, and More

Regarding the IRS guidelines, relatives such as parents or grandparents who live with you and who you financially support can also be considered dependents. A qualifying relative must live with you all year. Although this qualification is typically for elderly relatives such as parents who need assistance, additional relatives such as an uncle, aunt, sister-in-law, and more can qualify if they live under your roof.

However, there are exceptions to which family members under your roof qualify as a dependent. Although your children and other relatives living with you may qualify as dependents, your spouse will not. As you can see, things can get a bit complicated with taxes when it comes to claiming family members as dependents.

Complications like this are why it helps to consult a tax professional when you’re unsure of someone’s tax relationship to you. For example, we provide personal income tax preparation at Accutax Business Center to help individuals ensure they supply and file accurate information, including their dependents. After all, if you can save money on taxes, you deserve to claim the benefits you qualify for every year. Now that you understand how dependents work, we can explain how claiming a dependent can lower your taxes.

Dependent-Related Tax Credits

Claiming someone as your dependent carries various tax benefits, such as credits. This includes the earned income tax credit (EITC). The EITC isn’t just about dependents. This credit exists to help low-to-moderate-income households reduce the amount of taxes they owe. You may even be able to increase your refund when qualifying for EITC.

In most cases, having dependents increases the amount of your credit from the EITC, which helps you save more during tax season. If you are still unsure if you qualify for this tax credit, consult a professional who can look at your specific income, dependents, and more details to provide an accurate assessment.

Child Tax Credit

Another credit you may qualify for if you claim dependents is the child tax credit (CTC). The IRS grants this credit as a tax break to those with children under the age of 17 who qualify as a dependent. In 2022, this credit was worth $2,000, but that may differ for each year after, so talk to your tax expert about the current qualifications.

The IRS guidelines ensure that you can gain the full benefit of the CTC as long as your income does not exceed $200,000. If you file jointly with your spouse, then you will qualify for the CTC as long as your joint income is under $400,000. Another potential benefit of claiming dependents is earning the head of household status.

Head of Household

Everyone chooses a filing status when completing their taxes, and one of the options available is head of household. The IRS will allow you to qualify for the head of household status if you have a dependent in your household, you are not currently married, and if you paid for over half the cost of maintaining your home all year. So, what are the benefits of filing as head of household?

This status can save you money by providing a higher deduction than filing as single will. Remember that simply being single isn’t what earns you the right to choose this status. If you have dependents and are single, you may qualify as a head of household per IRS requirements. Talk with a tax expert now if you’re ready to learn more about how you can ensure your dependents are always accounted for when filing taxes.