10 Common Mistakes Small Businesses Make When Filing Taxes

Despite the presence of “small” in the moniker, a small business has plenty of big responsibilities, just like any business. The smaller your team, the easier it is to run into problems when overextending your abilities.

Important details, such as accurate tax filings, sometimes fall by the wayside. Suffice it to say that tax filings are not small details to overlook. Our extensive list details 10 of the most common mistakes small businesses make when filing taxes. Catch up on these common mistakes today so you can avoid running into them in the future.

Mixing Personal and Professional Expenses

One of the most important things for a business owner to remember is to separate personal and business expenses. Mixing these expenses can make it difficult to track business expenses for tax purposes.

If you don’t have a separate bank account and credit card for your business, it’s easy to overlook deductions and personal expenses to your filings on accident. Even if you’re a small business owner that works from home with little to no staff, you should separate your professional and personal expenses. Whether your business is big or small, accurate tax filing is a must every year.

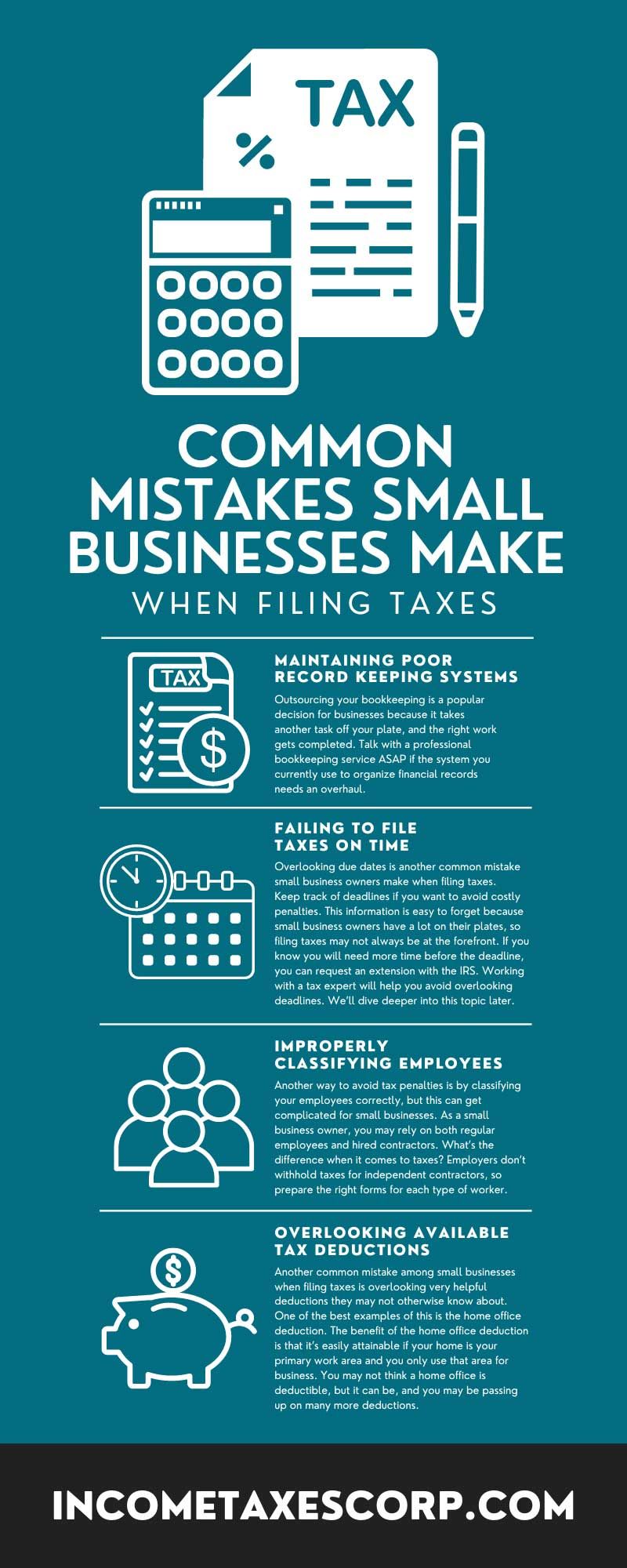

Maintaining Poor Record Keeping Systems

If you’re improvising a bookkeeping system with piles of receipts or a messy collection of digital documents, now is the perfect time to clean up that collection. Poor recordkeeping can lead to inaccurate results or an inefficient filing process when the time comes, but you can avoid both with careful prep.

Outsourcing your bookkeeping is a popular decision for businesses because it takes another task off your plate, and the right work gets completed. Talk with a professional bookkeeping service ASAP if the system you currently use to organize financial records needs an overhaul.

Failing To File Taxes on Time

Overlooking due dates is another common mistake small business owners make when filing taxes. Keep track of deadlines if you want to avoid costly penalties. This information is easy to forget because small business owners have a lot on their plates, so filing taxes may not always be at the forefront. If you know you will need more time before the deadline, you can request an extension with the IRS. Working with a tax expert will help you avoid overlooking deadlines. We’ll dive deeper into this topic later.

Improperly Classifying Employees

Another way to avoid tax penalties is by classifying your employees correctly, but this can get complicated for small businesses. As a small business owner, you may rely on both regular employees and hired contractors. What’s the difference when it comes to taxes? Employers don’t withhold taxes for independent contractors, so prepare the right forms for each type of worker.

Overlooking Available Tax Deductions

Another common mistake among small businesses when filing taxes is overlooking very helpful deductions they may not otherwise know about. One of the best examples of this is the home office deduction. The benefit of the home office deduction is that it’s easily attainable if your home is your primary work area and you only use that area for business. You may not think a home office is deductible, but it can be, and you may be passing up on many more deductions.

Choosing Tax Deductions They Do Not Qualify For

It’s easy to select the wrong tax deduction if you’re not very familiar with the options available. For instance, if you don’t understand the ins and outs of the home office deduction, you might assume that having a home office is enough. However, as you learned in the previous section, there are caveats to consider before assuming you qualify, such as how frequently you use that space for work.

The IRS has extensive resources on its website about deductions, regulations, and more. Don’t worry; we’re not saying you have to spend all night reading the IRS website to learn the essentials. Talk with a tax professional about how you can take advantage of deductions in the context of your current company structure.

Picking the Wrong Entity

A frequent mistake made by small business owners when filing taxes is choosing the wrong entity when they don’t fully understand their structure and the difference between each one. Your entity options include limited liability company (LLC), sole proprietorship, corporation, S-corporation, and partnership. Filing as the right entity is critical because it impacts the taxes you owe. Consult your business’s tax professional to learn how your structure influences taxes.

Overreporting Business Income

From fines to fraud, misreporting your income can have various unenjoyable consequences. Overreporting your income is easy to do if you’re estimating instead of relying on good bookkeeping. In addition, it’s common for small businesses to count sales tax on products as income, even though it is not taxable income.

Underreporting Business Income

Another common way to misreport income is by underreporting it. If you claim your business made less than it actually did, the IRS will take notice and follow up with an audit. Accidentally underreporting income won’t automatically place fraud charges on your business, but that doesn’t mean there won’t be consequences. Carefully track your income throughout the year if you want to avoid fines or an inefficient filing process.

Neglecting To Use Good Tax Preparation Services

A commonality among the above mistakes is that they are easier to avoid when you have tax preparation services on your side. Unfortunately, a common mistake that businesses make is neglecting to hire a tax prep expert in an effort to save money. However, working with a tax expert will help you avoid fines and ensure you have accurate tax information throughout the year and when filing deadlines arrive.

For example, at Accutax Business Center, we offer services such as small business tax filing to partner you with accountants that will make tax prep easy and efficient every year. Reach out when you’re ready to avoid all the mistakes above so you can focus more on the many facets of your small business.